A new policy brief from Michigan State University and Wayne State University researchers finds that in an era of highly partisan politics, the Growing Michigan Together Council succeeded in finding common ground among members from diverse backgrounds and with diverse perspectives. However, despite the council’s best efforts, the brief states that the vision for education cannot be implemented, beyond relatively modest initiatives, without new revenues and a reversal of the state’s long-term disinvestment in public services.

The policy brief is based on the Growing Michigan Together Council’s, or GMTC’s, December 2023 report on strategies to increase the state’s population and prosperity, in which education and training play a central role and are the focus of this policy brief.

“We applaud the council’s accomplishments and, in this brief, augment its vision of schools as engines of community economic development,” said co-author David Arsen, professor emeritus of education policy and educational administration in the MSU College of Education. “The council did not, however, assess the costs and revenue requirements of its suggested policy solutions. We set out to fill that gap by showing that additional state revenues are needed and attainable. The payoff will be more robust and balanced growth of communities statewide.”

The Growing Michigan Together Council was established by Gov. Gretchen Whitmer in June 2023 to develop a long-term vision that addresses current and future challenges and sets Michigan up for success in the 21st century.

According to the brief, the GMTC report correctly views public schools as sites for developing workforce skills and competencies that will spur local and regional economic development. But schools significantly influence community development in many more ways than this.

“Public schools are an absolutely key part of any community’s public infrastructure,” Arsen said. “They are important sites for the civic, cultural, sporting and recreational activities that the report sees as essential for thriving communities. As such, they are key settings for enhancing engagement and social ties among local residents, including the integration of newcomers with long-time residents, which the report seeks to promote.”

Public schools are also inextricably linked to communities’ economic base. First, they constitute a major source of nonlocal income injected into communities from state and federal sources. Second, they are one of the largest, if not the largest, employers in any community, providing a significant source of relatively stable jobs for those with and without college degrees. Third, schools are important purchasers of services from local businesses, as are resident and nonresident families drawn to school-based activities. And, finally, as the council recognizes, they prepare young people for a range of critically important jobs in the local economy.

However, Michigan communities are limited in their own ability to realize the multiple community benefits of well-resourced schools because state policymakers control most school funding decisions.

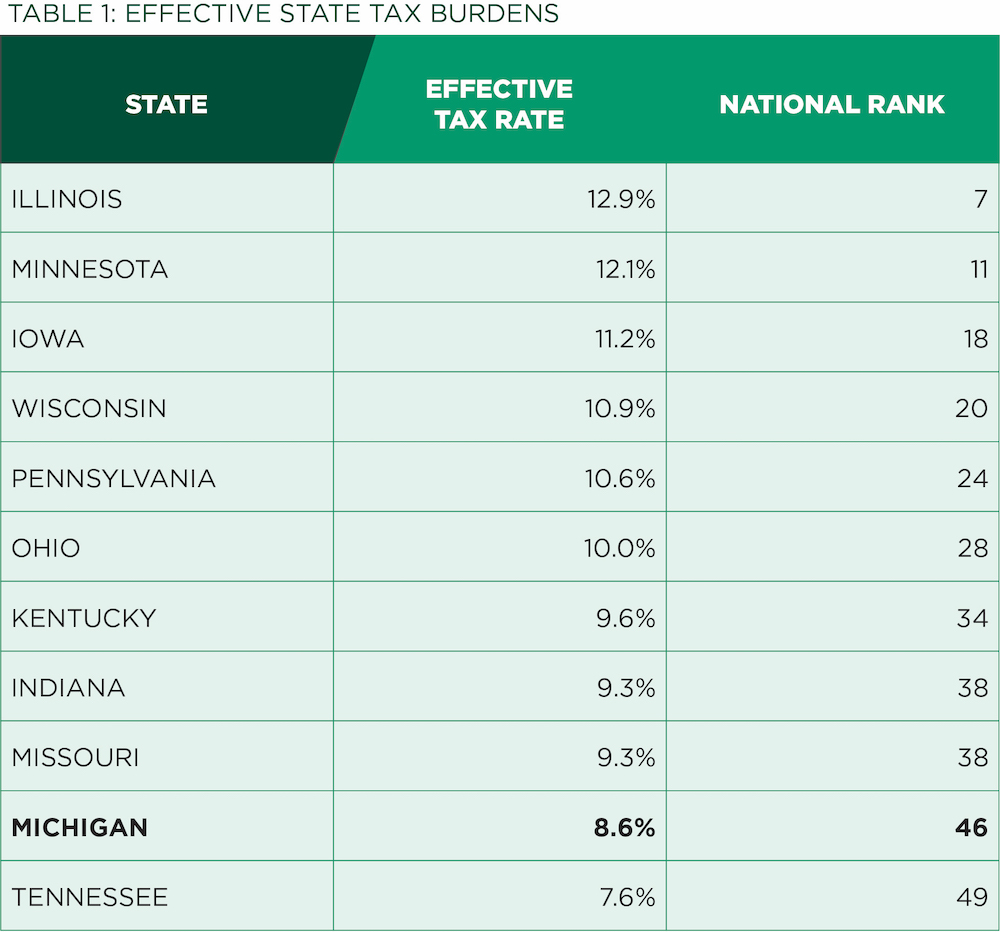

Over the last four decades, as Michigan’s population and income growth seriously lagged behind other states and the nation as a whole, the state’s taxation levels also steadily fell. As a result, Michigan is a dramatically lower-tax state now than back in the era when it was among the nation’s most prosperous states.

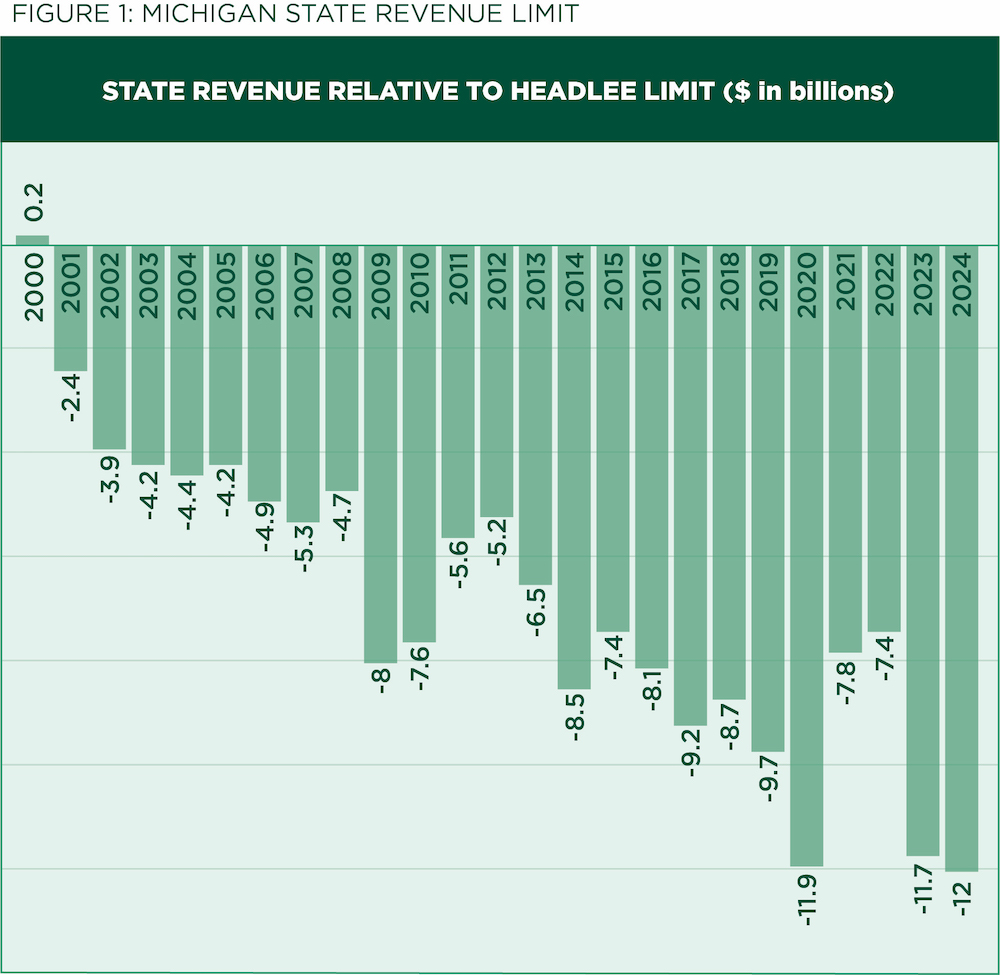

“Today, annual state revenue collections are $12 billion below the 1978 Headlee constitutional amendment that caps state revenue at a fixed percentage of state personal income. This disinvestment is apparent in specific policy areas such as education,” said Mike Addonizio, professor emeritus of education leadership and policy studies at Wayne State University.

“Between 1995 and 2015, Michigan was dead last (50th) among states in total prekindergarten through grade 12 education revenue growth, and 48th among the states in per pupil funding growth. This is a problem.” Addonizio said.

According to the brief, the nonpartisan 2018 School Finance Research Collaborative, or SFRC, study provides a very sound cost analysis of needed resources that aligns quite well with the GMTC’s goals, including resources providing a range of social and economic benefits to vibrant communities. About $4.5 billion of additional revenue would be needed to fund the SFRC’s recommended school staffing.

“More than enough revenue to meet this goal would be generated if Michigan devoted the same portion of our statewide income to pre-K through 12th grade education today as we did as recently as 2011 or, alternatively, any earlier year over the last several decades,” Arsen said. “In the current era of sharply increased income inequality, taxpayers with the highest ability to pay should lead the way. A graduated state income tax could generate additional state revenues with higher rates on very high incomes while reducing tax rates for most taxpayers. This may be the most promising approach to fund investments that are so essential for a more prosperous Michigan.”