Retailers are gearing up for another blockbuster holiday shopping season, but consumers burned by the highest inflation in a generation may have other ideas.

Industry groups are predicting another record year of retail sales, with the National Retail Federation forecasting a jump of 6% to 8% over the $889 billion U.S. consumers spent online and in stores during November and December of 2021.

Ayalla Ruvio and Forrest Morgeson, faculty in the Department of Marketing in Michigan State University’s Eli Broad College of Business, recently asked more than 500 consumers a series of questions about their spending plans, concerns and priorities during this year’s holiday season. Their research found that consumers are reporting consumption behaviors typically exhibited during an economic crisis: An overwhelming 62% said they were concerned about their job security, while almost 35% indicated they were “very” or “extremely” worried about their financial situation.

Answers are excerpts from an article originally published in The Conversation.

How will inflation impact Black Friday this year?

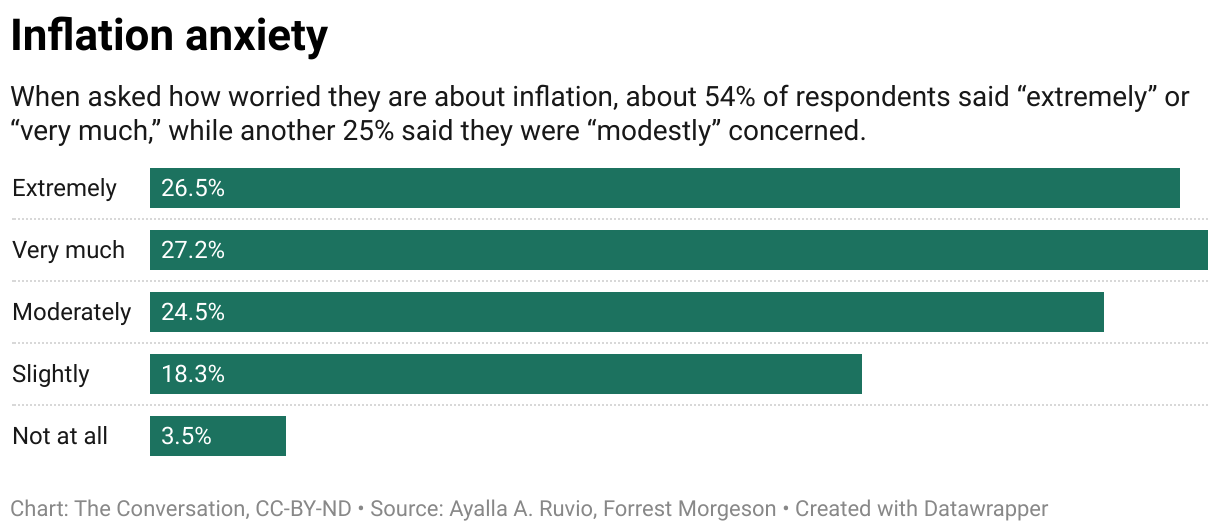

Not surprisingly, cutting spending is the first thing consumers do during economic turmoil. Inflation is one of the key reasons consumers say they are spending less. Almost 80% of respondents said they are either moderately, very or extremely concerned about the surge in prices, and 87% said those concerns would affect their holiday spending behavior, such as by buying gifts for fewer people or purchasing less expensive items.

Respondents said they plan to spend, on average, around $700 this holiday season, substantially less than the roughly $880 consumers spent during each of the past three holiday seasons.

About a third of the sample intended to spend “slightly” or “much” less than in 2021, while 35% said they would spend “about the same” — which, from a retailer’s perspective, means spending less because last year’s dollars don’t go as far today. The remaining respondents said they planned to spend a little more or much more than last year.

Some respondents even said they were planning to make their own gifts or buy used goods, rather than shop for new items. The secondhand market has boomed in the last few years, and many shoppers view this option as a way to combat inflationary pressures.

How important is price to holiday shoppers?

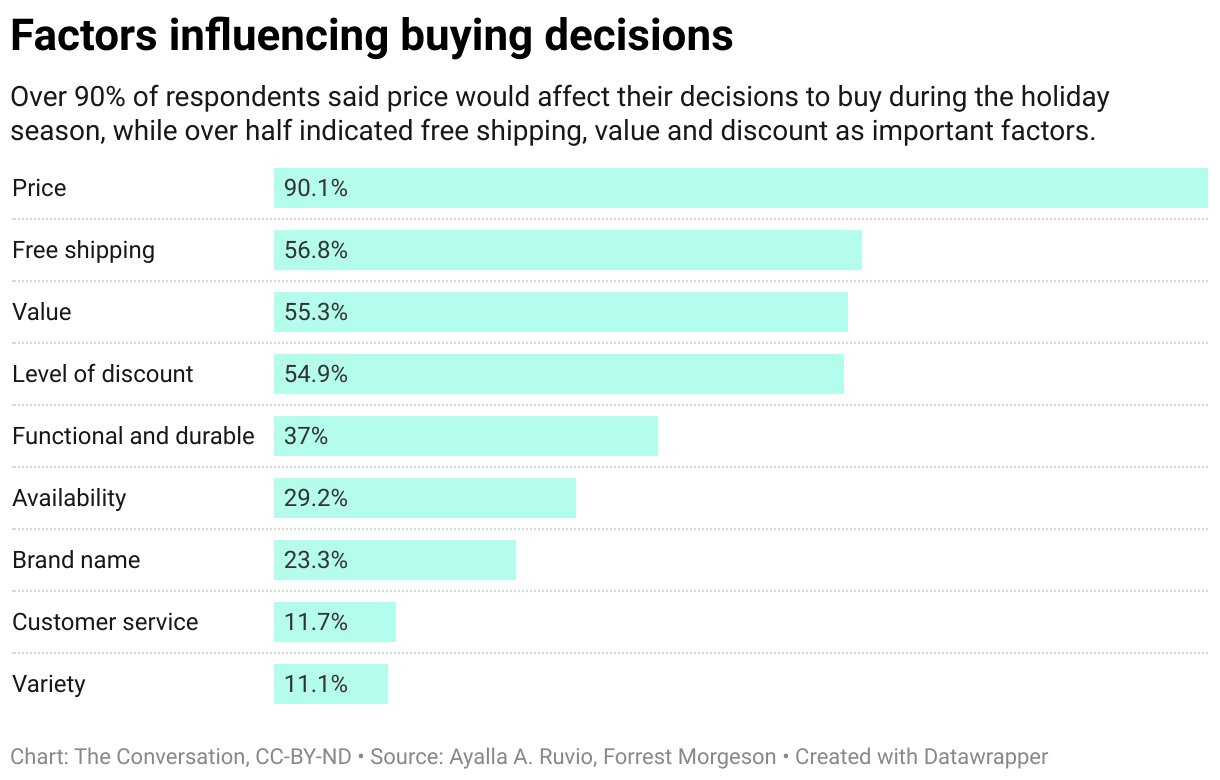

During economic crises, consumers become hypersensitive to prices, which trump most other considerations. A whopping 90% of respondents confirmed that price is their major consideration when shopping during the holidays this year. Other elements of price sensitivity are free shipping, product value and the level of discount, if any.

The singular focus of consumers on price gives retailers a wide range of potential responses, including promoting house brands and private labels that are perceived as having greater value for money spent. During an economic slowdown, consumers typically stop buying brands they are not strongly connected with or loyal to.

Consumers in our survey said buying brand names will be one of the least important influences on their purchases this season.

How can cost-conscious consumers be more strategic about how they shop?

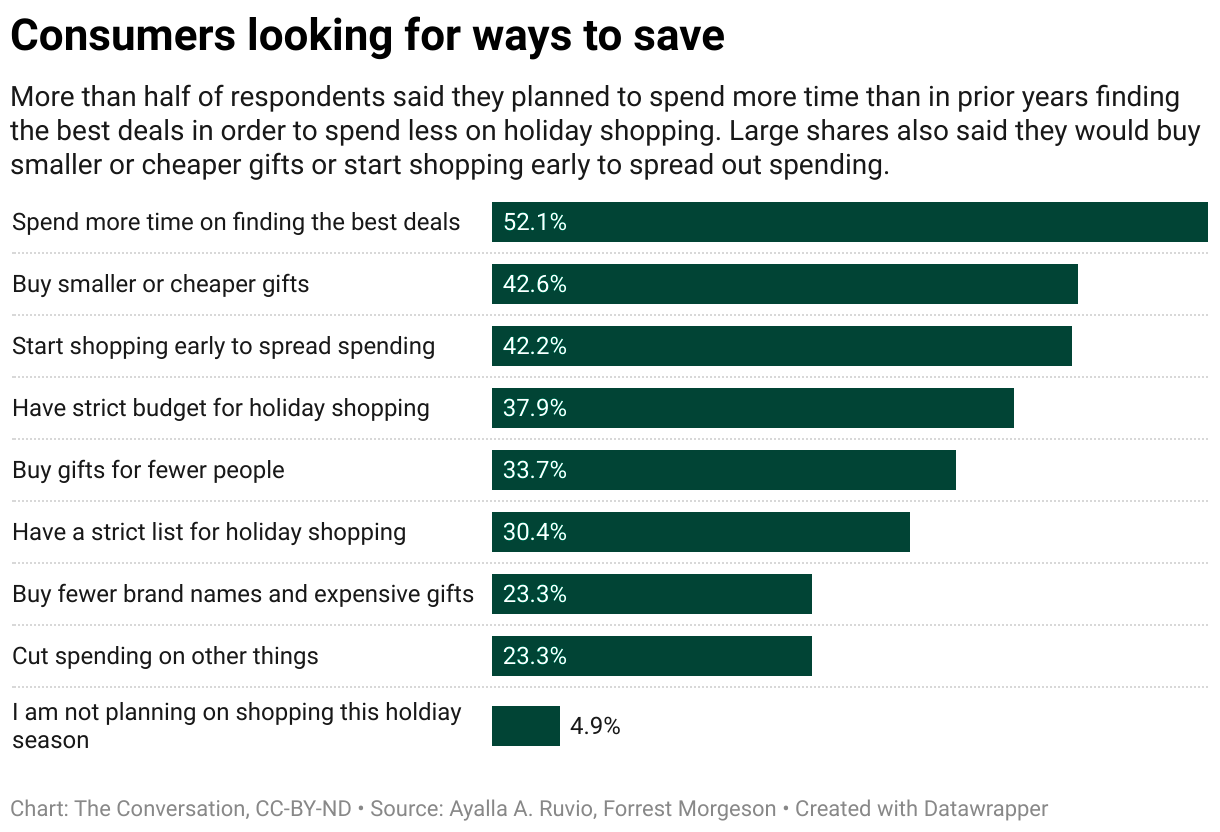

When consumers sense a troubled economy, they often plan their purchases more carefully and maintain self-control over spending.

Common strategies include spending more time searching for the best deals, adhering to strict shopping lists, prioritizing necessities and making purchases earlier to spread out spending — all of which were mentioned by our survey respondents.

We may already be seeing signs of this last strategy. Retail sales for October were up 1.3% from the previous month and up 8.3% from October 2021, which may reflect consumers’ early holiday shopping. If that is the case, this early shopping may result in reduced sales in December.

Also, purchasing early, aided by the plethora of steep discounts offered well in advance of Black Friday, allows consumers to control their shopping behavior better and reduces the risk of impulse buying. Reduction of impulse buying is a strong indicator that consumers are shopping like the economy is in recession.